DM Solar Group designs, installs, and maintains turnkey solar power systems for residential and commercial buildings. Using the world’s most abundant natural resource, we cut your energy costs and lock in predictable expenses for years to come. Each eco-friendly solar power system we provide is custom-engineered for the unique needs of your home or business.

Contact our team of solar experts today for a custom quote on a money-saving, carbon-reducing solution to your energy needs!

Millions of businesses and homeowners recognize that there is an unlimited and totally clean power supply located right above our heads. Thanks to modern advances in solar technology and production, it has never been easier and more affordable to harvest this free energy with a custom-designed solar power system. Renewable, sustainable, and efficient, solar energy can transform your home and business into a power-efficient electricity generator while significantly reducing your energy costs and dependence on your local power grid.

At DM Solar Group, we’ve mastered the art of converting sunlight into big energy savings for our clients. With comprehensive solutions designed specifically for residential and commercial energy needs, we offer more than just solar installations. We provide transparency, fiscal benefits, and a clear pathway to energy independence.

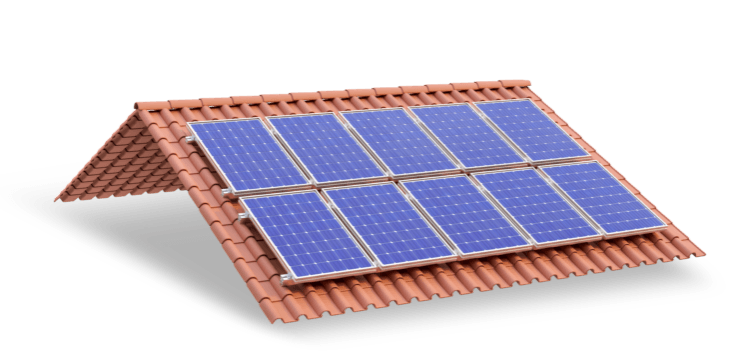

Reengineer the way your business operates with solar solutions tailored to your unique needs. Save on energy costs, reduce your dependence on the power grid, and mark your commitment to sustainability with a custom-designed solar array.

Step into a sustainable future with residential solar solutions that optimize your home’s energy footprint. Minimize your bills, maximize your energy efficiency, and embody the ethos of responsible energy use!

The Solar Investment Tax Credit (ITC) stimulates businesses and homeowners to invest in solar energy systems by offering significant financial benefits. This credit, currently set at 30%, directly deducts a portion of the installation cost from the tax bill of the owner, rather than a simple deduction from taxable income. A property that commences solar-panel construction in 2024 is eligible for a 30% ITC, so for a tax basis of $1,000,000, the 30% ITC would reduce tax liability by $300,000.

The Modified Accelerated Cost Recovery System (MACRS) allows businesses to recover the investment cost from their taxes more quickly. Under MACRS, solar PV owners can write off the asset value of a solar PV system within five years. This accelerated depreciation results in larger income tax savings and a substantial decrease in the solar energy system’s net cost. Combining MACRS with the ITC enables businesses to maximize their financial benefits, making customized solar power systems an even better deal.

Ready to harness the sun and start saving money? Contact DM Solar Group today. Our seasoned team will help you navigate the emerging landscape of solar energy. Fill out the short form below to get started on your custom quote.